43 definition of coupon rate

Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence? Coupon rate financial definition of Coupon rate The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

Definition of coupon rate

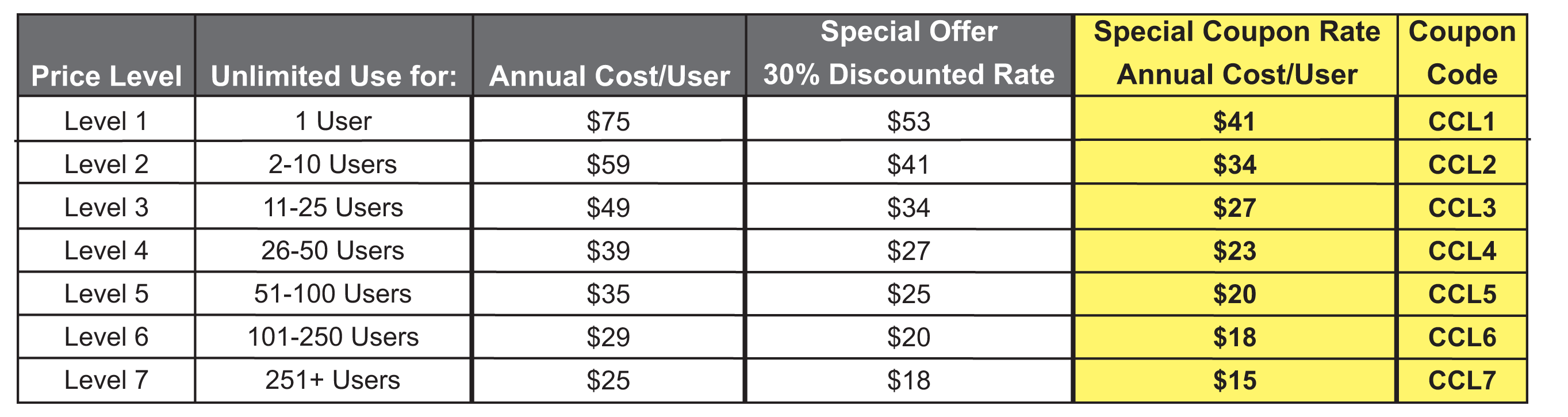

Coupon rate Definition | Nasdaq Coupon rate. In bonds, notes, or other fixed income securities, the stated percentage rate of interest, usually paid twice a year. Most Popular Terms: Earnings per share (EPS) Beta; Difference Between Coupon Rate and Required Return (With Table) Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100 ... Maximum Rate of Floating Rate Coupon Definition | Law Insider Examples of Maximum Rate of Floating Rate Coupon in a sentence. Acquired Bailey Operating, Inc., which extended the Company's core businesses into the Barnett Shale. If any Maximum Rate of Floating Rate Coupon or Minimum Rate of Floating Rate Coupon is specified in the relevant Final Terms, then any Floating Rate Coupon shall be subject to such maximum or minimum, as the case may be.

Definition of coupon rate. Bond Coupon Rate Definition | Law Insider 1. Bond Coupon Rate means the lower of (i) the rate set forth with respect to a series of the Bonds on the Schedule of Financial Terms and (ii) the Maximum Rate. Sample 1. Based on 1 documents. 1. Bond Coupon Rate means the rate of interest accruing on the Bonds based on the Interest Rate Mode then in effect. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. › macaulay-durationMacaulay Duration (Definition, Formula) | Calculation with ... It is determined by, 1 / {1 * (1 + Discount Rate) Period Number} read more. We can use the following semi-annual interest formula to derive the discount factor. 1 / (1 + r)n, where r is the coupon rate, and n is the number of periods compounded. Discount Factor. Calculation of discount factors for 6 months will be –

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula The coupon rate calculations formula is simple. Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. Coupon Rate Formula | Step by Step Calculation (with Examples) coupon rate = annualized interest payment / par value of bond * 100% read more " refers to the rate of interest paid to the bondholders by the bond issuers the bond issuers bond issuers are the entities that raise and borrow money from the people who purchase bonds (bondholders), with the promise of paying periodic interest and repaying the …

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer Maximum Rate of Floating Rate Coupon Definition | Law Insider Examples of Maximum Rate of Floating Rate Coupon in a sentence. Acquired Bailey Operating, Inc., which extended the Company's core businesses into the Barnett Shale. If any Maximum Rate of Floating Rate Coupon or Minimum Rate of Floating Rate Coupon is specified in the relevant Final Terms, then any Floating Rate Coupon shall be subject to such maximum or minimum, as the case may be. Difference Between Coupon Rate and Required Return (With Table) Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100 ... Coupon rate Definition | Nasdaq Coupon rate. In bonds, notes, or other fixed income securities, the stated percentage rate of interest, usually paid twice a year. Most Popular Terms: Earnings per share (EPS) Beta;

Post a Comment for "43 definition of coupon rate"