41 coupon vs zero coupon bonds

Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

Coupon vs zero coupon bonds

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Coupon vs zero coupon bonds. ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news. Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Some of the key bonds are Municipal bonds, Governments bonds, corporate bonds, Zero Coupons bonds, etc. Bonds also called fixed-income instruments. Example: Some of the key features of Treasury Bills are as listed below. T-Bonds are long-term investment bonds issued by the government to finance the ongoing operation of government services. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Warrant (finance) - Wikipedia In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary and have expiration dates. They differ mainly in that warrants are ...

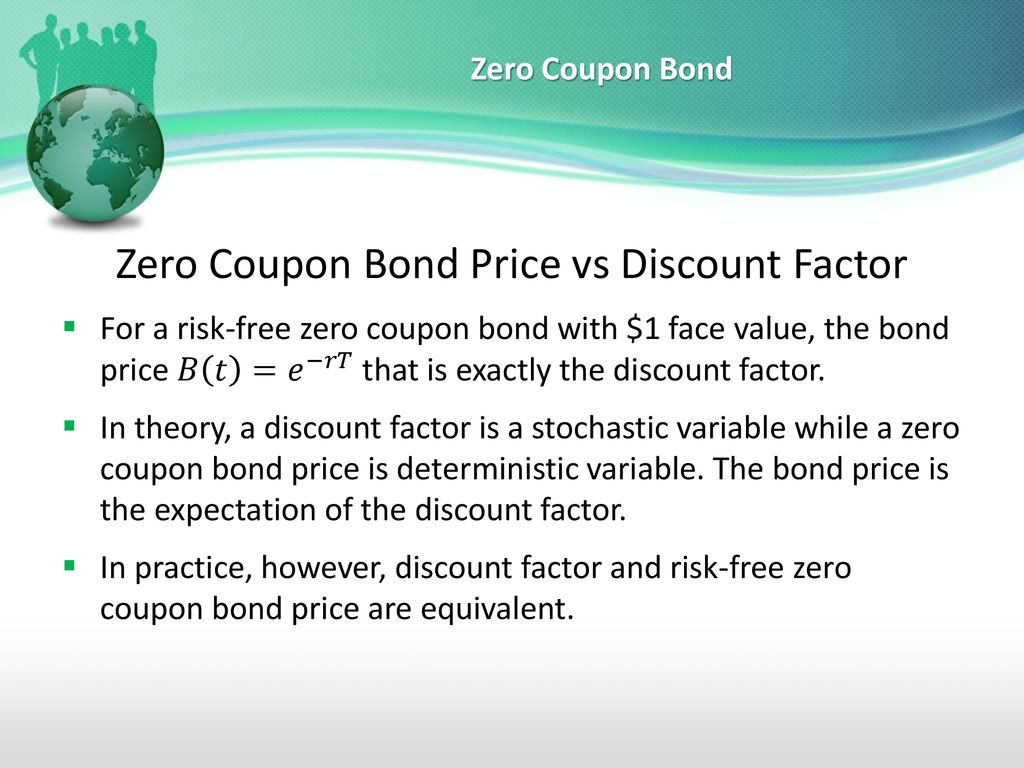

About Discount Bonds versus Zero Coupon Bonds - Accounting V17 - Confluence Zero Coupon bonds generally have a Maturity Date that is more than a year and a half out from the issue date. Unlike discount bonds, Zero Coupons do take compounding into account, and are generally issued with a semi-annual compounding yield; therefore, they have a Payment Frequency equal to the standard payment frequency of semi-annual. Bond Discount - Investopedia May 29, 2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ... Zero Coupon Bonds Explained (With Examples) - Fervent The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. And that's ultimately because for the most part, zero coupon bonds tend to be riskier securities. The higher interest rate / higher yield is meant to compensate for, or pay for, the higher risk.

Explain Zero Coupon Bonds versus Coupon Bonds - QS Study The zero coupon bond contrasts with the coupon bond, and is the most straightforward of all bonds. The face of the certificate has the name of the investor, the nominal (face) value and the maturity date. It is issued at a discount rate, which reflects the interest rate that the investor is prepared to pay, i.e. the market rate for 3-year money. What's the difference between a zero-coupon bond and a Treasury ... - Quora But if you want to compare directly just a specific bullet bond with a single zero coupon, there will be less P/L swings as the coupon bond will have less duration and less convexity. Meaning less P/L volatility. In fact the bigger the change in rat Continue Reading Quora User Upvoted by James Feigenbaum What is the difference between a zero-coupon bond and a regular ... - Quora Simple, zero coupon bonds are sold at significantly lower prices or at deep discounts- say a bond with a face value of $1000 will sell for lower than its face value say $750. So at maturity while the investor would not receive any interest, he will receive the full face value of the bond. Profit=$1000-$750=$250 (Numbers are meant purely Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the life of the bond by being ...

Zero-Coupon Bonds and Taxes - Investopedia The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not...

Equity vs Fixed Income - A Side by Side Comparison Feb 04, 2022 · A zero-coupon bond (or zero) promises a single cash flow, equal to the face value (or par value) when the bond reaches maturity. Zero-coupon bonds are sold at a discount to their face value. The return on a zero-coupon bond is the difference between the purchase price and the bond’s face value. A coupon bond, similarly, will also pay out its ...

Difference Between a Zero Coupon CD & a Bond | Finance - Zacks Both bonds and zero coupon certificates of deposit, or CDs, are debt securities, meaning the issuer of the bond or zero coupon CD promises to repay the investor the principal sum in addition to ...

Bond vs Loan | Top 7 Best Differences (with Infographics) Interest rates on bonds either could be fixed, variable, or there could be no interest either, like in the case of zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay ...

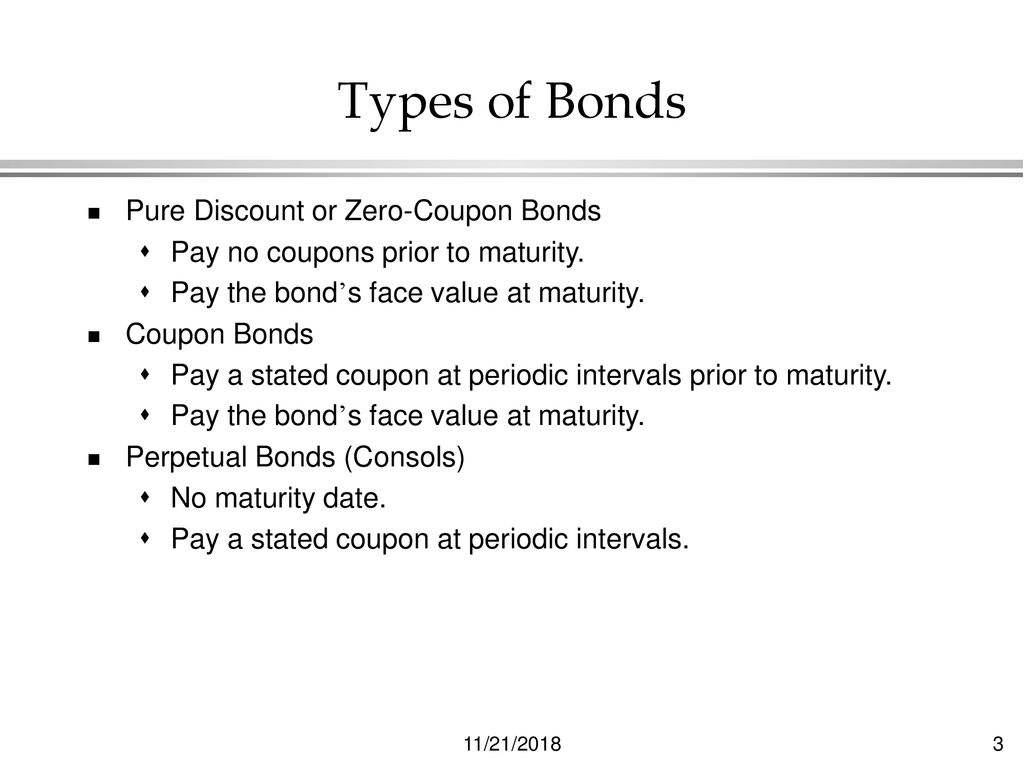

All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Different Types of Bonds Plain Vanilla Bonds. A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon …

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return

Deep Discount bonds and Zero Coupon Bonds - The Fixed Income Deep Discount bonds and Zero Coupon Bonds. In 1992 investors were drawn to exciting advertising by Industrial Development Bank of India (IDBI), a Central Government promoted Development Financial Institution, calling for subscription to its Flexi-Bonds. The terms were mouth-watering, offering bonds with a face value of Rs. 1 lakh for Rs. 2,700.

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

Post a Comment for "41 coupon vs zero coupon bonds"