39 bond yield vs coupon rate

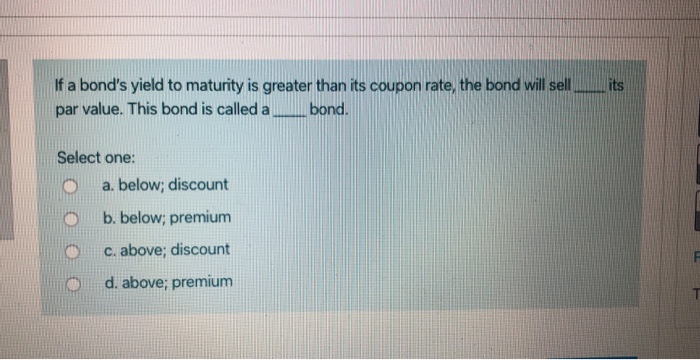

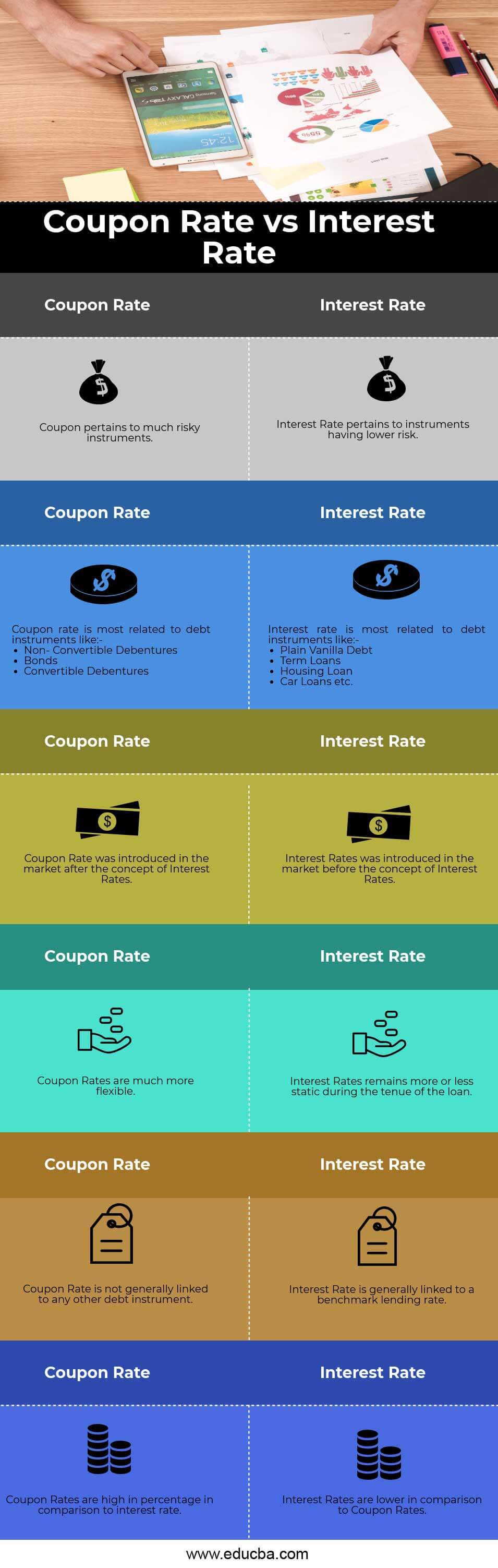

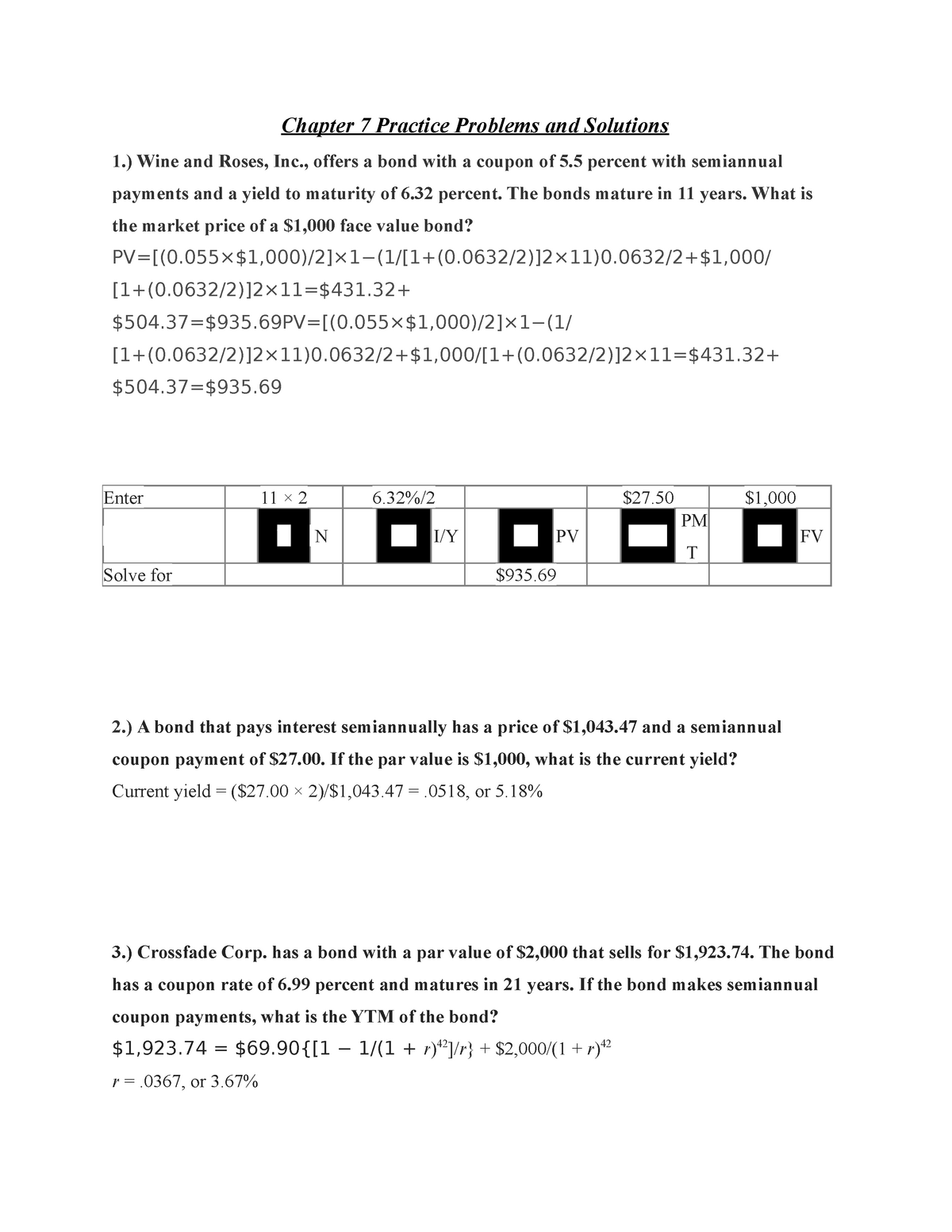

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. Coupon vs Yield | Top 5 Differences (with Infographics) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40.

Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Bond yield vs coupon rate

The Difference Between Coupon and Yield to Maturity 4 Mar 2021 — To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · A bond's current yield, however, is different: a percentage based on the coupon payment divided by the bond's price, it represents the bond's effective return. Coupon Interest Rate vs. Yield Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

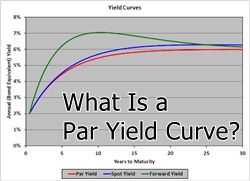

Bond yield vs coupon rate. Difference Between Yield & Coupon Rate 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount ... Learn How Coupon Rate Affects Bond Pricing 5 days ago — The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... The Predictive Powers of the Bond Yield Curve - Investopedia Jun 29, 2022 · A two-year bond could offer a yield of 6%, a five-year bond of 6.1%, a 10-year bond of 6%, and a 20-year bond of 6.05%. Such a flat or humped yield curve implies an uncertain economic situation.

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · A bond's current yield, however, is different: a percentage based on the coupon payment divided by the bond's price, it represents the bond's effective return. Coupon Interest Rate vs. Yield The Difference Between Coupon and Yield to Maturity 4 Mar 2021 — To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount ...

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

![Difference Between Current Yield and Coupon Rate [Updated 2022]](https://askanydifference.com/wp-content/uploads/2022/10/Current-Yield-vs-Coupon-Rate.jpg)

Post a Comment for "39 bond yield vs coupon rate"