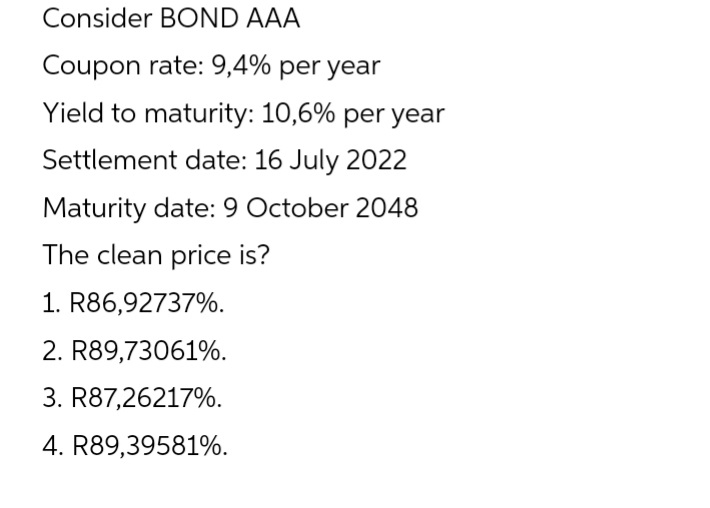

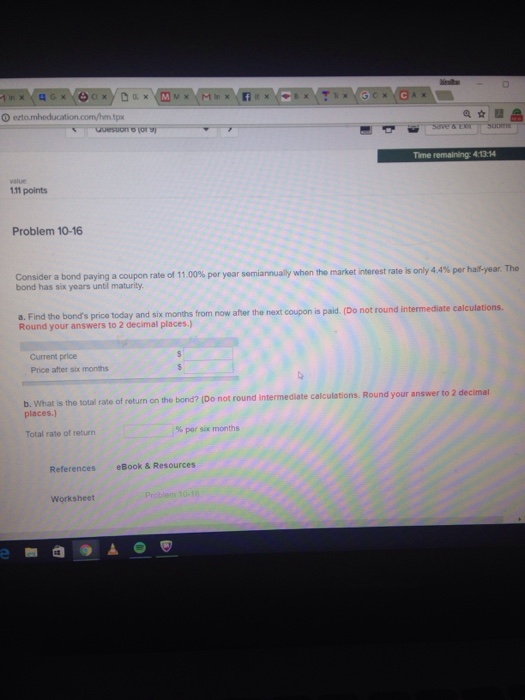

45 consider a bond paying a coupon rate of 10 per year semiannually when the market

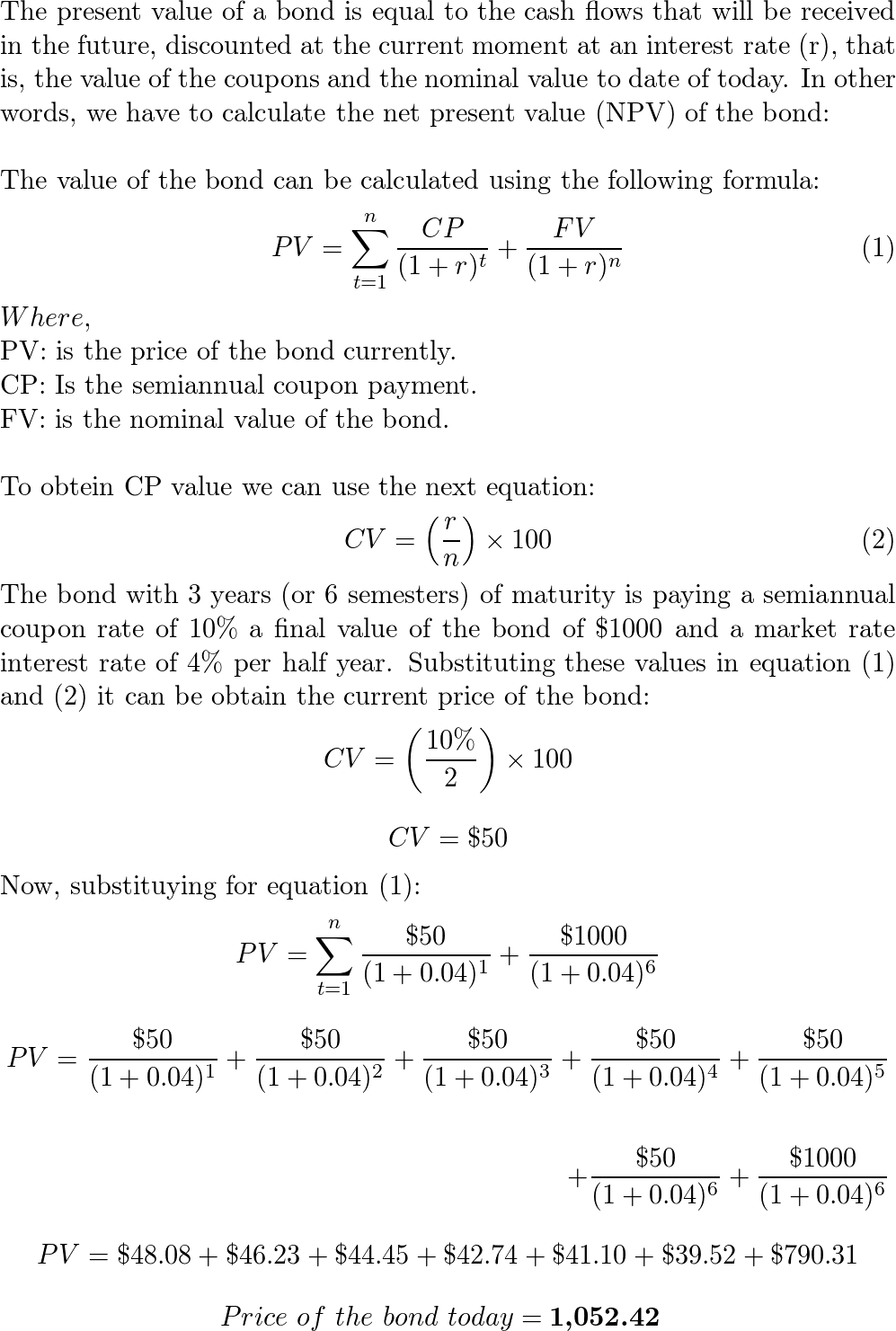

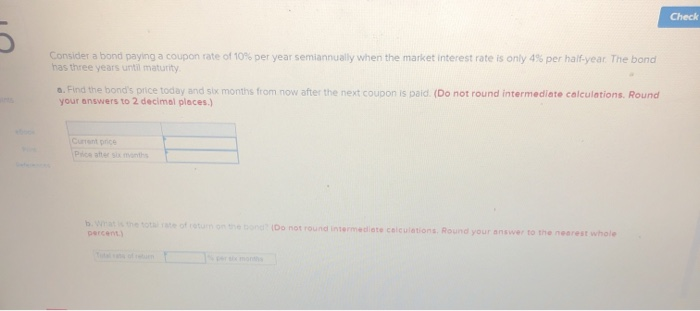

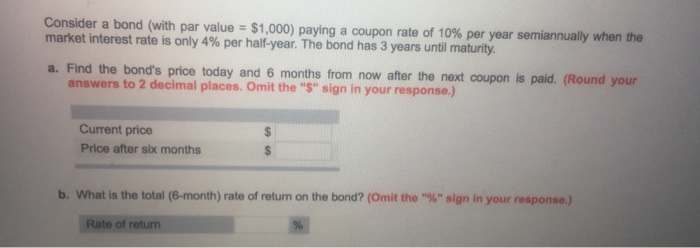

OneClass: Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Pro Rata: What It Means and the Formula to Calculate It - Investopedia 18/07/2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

Publication 537 (2021), Installment Sales | Internal Revenue ... Complete Form 6252 for each year of the installment agreement, including the year of final payment, even if a payment wasn’t received during the year. If you sold a marketable security to a related party after May 14, 1980, and before 1987, complete Form 6252 for each year of the installment agreement, even if you didn’t receive a payment.

Consider a bond paying a coupon rate of 10 per year semiannually when the market

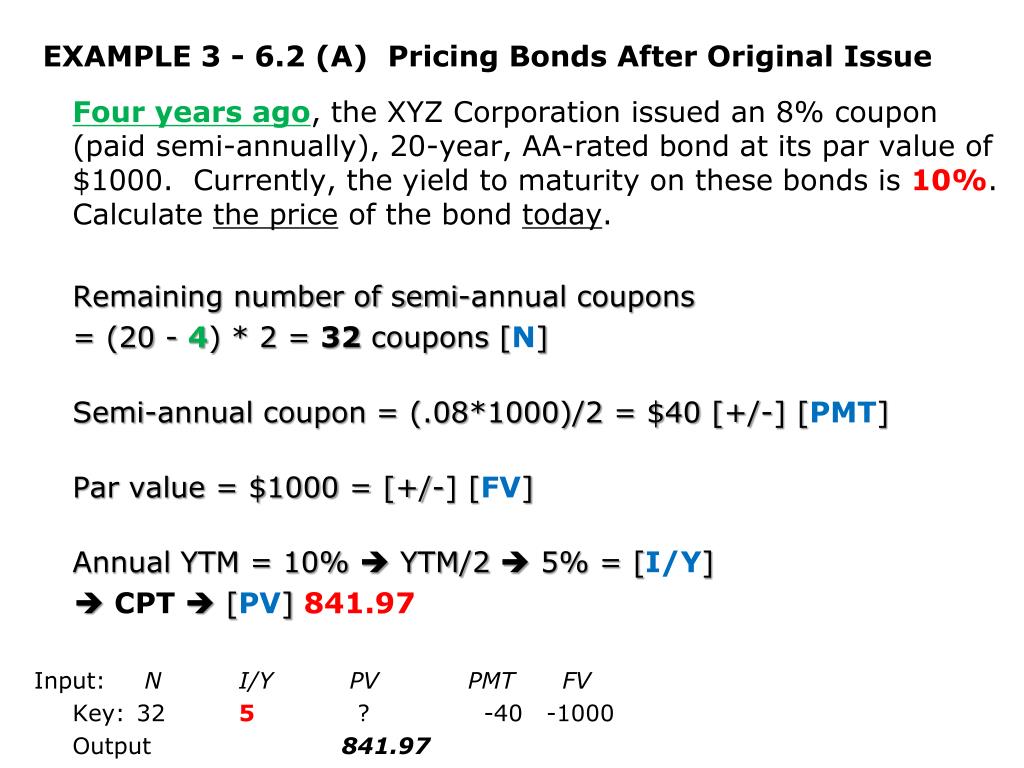

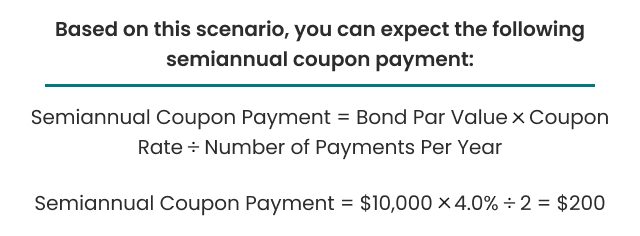

The Power of Compound Interest: Calculations and Examples - Investopedia 19/07/2022 · Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan . Thought to have ... Consider a bond paying a coupon rate of 10% per year semiannually when ... Using a financial calculator , you can solve for bond price with the following inputs; Maturity of bond (as of today); N = 3*2 = 6 Face value ; FV = 1000 Semiannual coupon payment; PMT = (10%/2 )*1000 = 50 Semiannual interest rate; I/Y = 4%/2 = 2% then CPT PV = $1,168.04 6-months from today, you will use the following inputs to find new price; Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond?

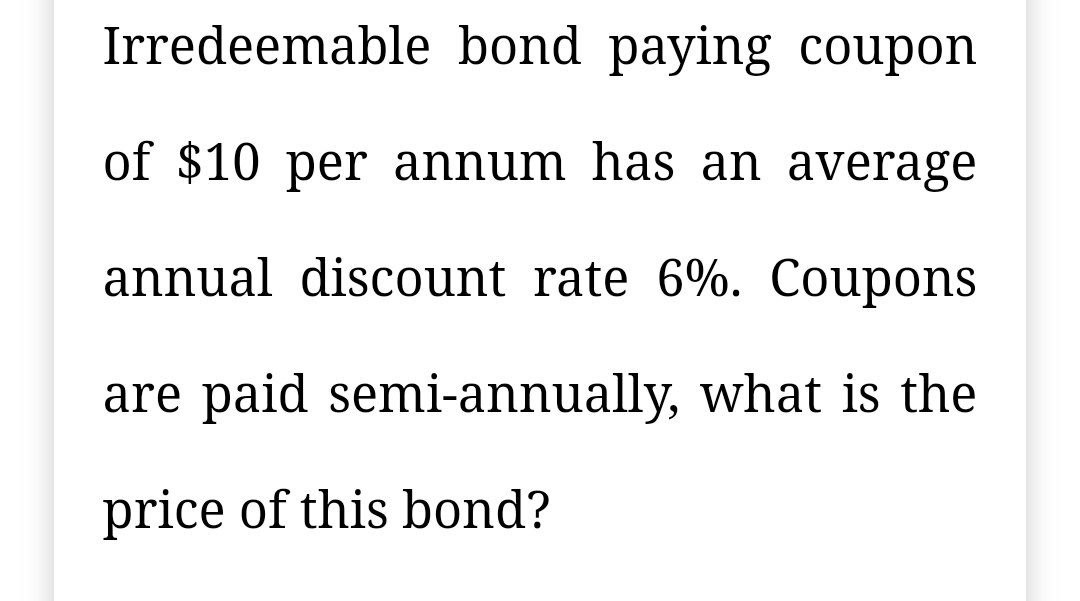

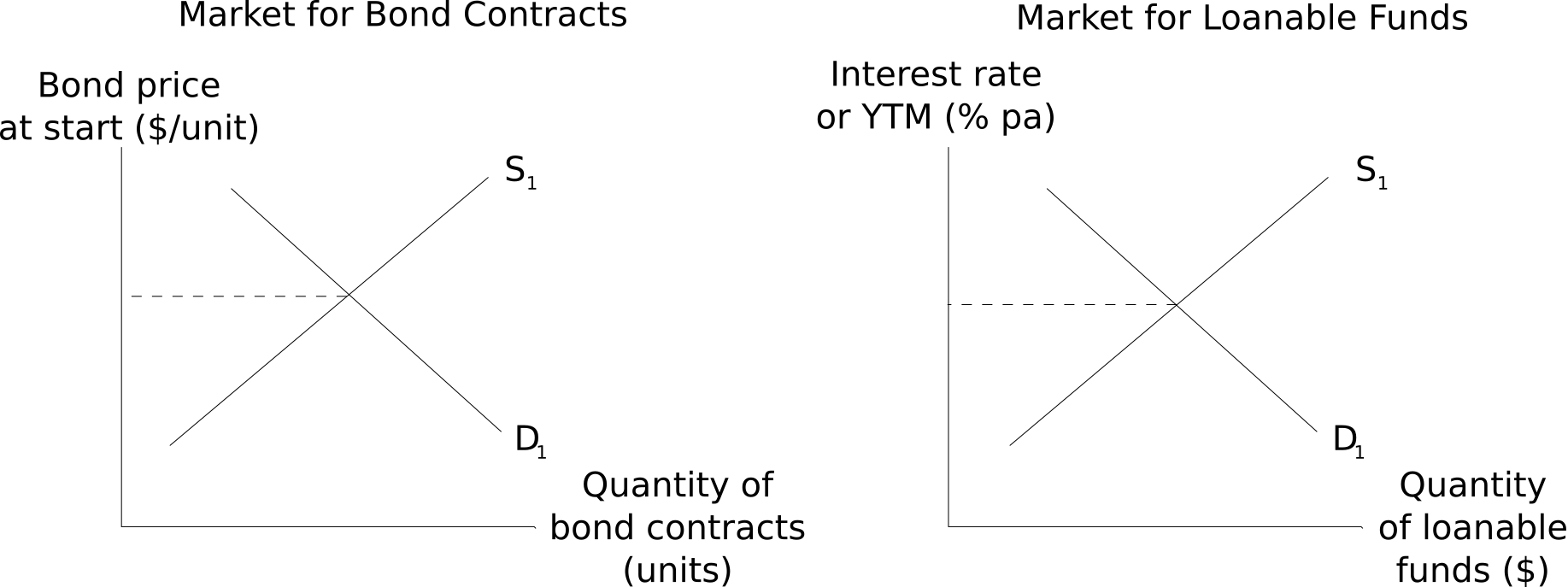

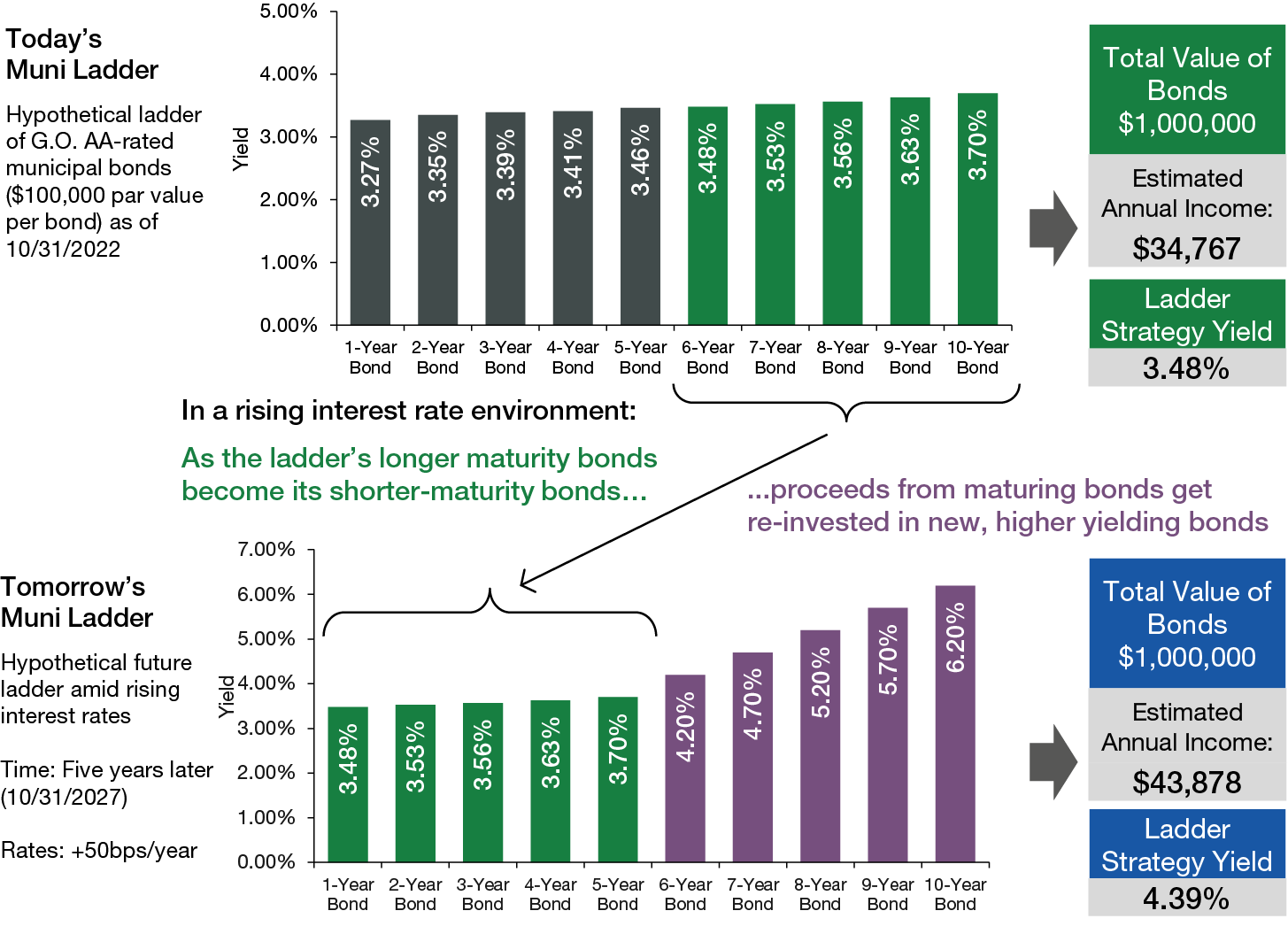

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Publication 550 (2021), Investment Income and Expenses You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. Guide to Fixed Income: Types and How to Invest - Investopedia Aug 31, 2022 · Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Fixed-income investments can be used to ... Interest - Wikipedia Compound interest includes interest earned on the interest that was previously accumulated. Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year.The total interest payment is $6 per $100 par value in both cases, but the holder of the semiannual … Answered: A few years ago, I decided to expand my… | bartleby A: We have; Time to maturity of bond is 5 years Annual coupon rate is 8% YTM is 7% YTM after 1 year is… question_answer Q: Question 6 Prior to the 2008 financial crisis, how did the selling of bonds by the Fed impact the…

Achiever Papers - We help students improve their academic ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life. Solved Consider a bond paying a coupon rate of 10% per year - Chegg Question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? This problem has been solved! Consider a bond (with par value = $1,000) paying a coupon rate of 10% ... Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 7% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.) Lic Housing Finance Limited - Bond Price, Yield Percentage, Coupon Rate ... In order for that bond paying 8% to become equivalent to a new bond paying 9%, it must trade at a discounted price. Likewise, if interest rates drop to 7% or 6%, that 8% coupon becomes quite attractive and so that bond will trade at a premium to newly issued bonds that offer a lower coupon.

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) How Do Bond ETFs Work? | ETF.com A hypothetical $100 bond has a 5 percent coupon — meaning, every year, the bond will pay out $5 to investors until it matures. Then interest rates rise 2 percent. Then interest rates rise 2 percent. Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? BusinessFinance Answer Step #1 of 3 a) Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid. b) What is the total rate of return on the bond? Dec 28 2021 | 05:26 PM | Solved

Solved Consider a bond paying a coupon rate of 10% per - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6 month) rate of return on the bond? Expert Answer

Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid. Solutions Verified Solution A Solution B Create an account to view solutions

Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year.

Assignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ...

Success Essays - Assisting students with assignments online If you want a cheap essay, place your order in advance. Our prices start from $11 per page. F.A.Q. Frequently Asked Questions. ... The average quality score at our professional custom essay writing service is 8.5 out of 10. The high satisfaction rate is set by our Quality Control Department, which checks all papers before submission. The final ...

Consider a bond paying a coupon rate of 10% per year...open 5 Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate... Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per half a year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid.

Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond

Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond?

Consider a bond paying a coupon rate of 10% per year semiannually when ... Using a financial calculator , you can solve for bond price with the following inputs; Maturity of bond (as of today); N = 3*2 = 6 Face value ; FV = 1000 Semiannual coupon payment; PMT = (10%/2 )*1000 = 50 Semiannual interest rate; I/Y = 4%/2 = 2% then CPT PV = $1,168.04 6-months from today, you will use the following inputs to find new price;

The Power of Compound Interest: Calculations and Examples - Investopedia 19/07/2022 · Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan . Thought to have ...

:max_bytes(150000):strip_icc()/manlookingatcomputer-2368f094bfc7428b8e7b86e34186139d.jpeg)

Post a Comment for "45 consider a bond paying a coupon rate of 10 per year semiannually when the market"